Is manual data entry slowing down your credit and lending workflows? In the fast-paced financial environment, speed and accuracy are non-negotiable. Financial statement spreading is one critical function that directly impacts lending decisions, credit assessments, and risk analysis.

This blog explores how automation transforms financial statement preparation in commercial lending, investment analysis, and underwriting. From eliminating errors and delays to improving financial intelligence, we’ll explain why automation isn’t just beneficial, it’s essential. If your team still relies on spreadsheets and manual extraction, it’s time to rethink your approach.

The Problem With Manual Spreading

Traditionally, financial analysts and credit officers have spent hours combing through PDFs, spreadsheets, and scanned documents to complete financial statement spreading. Each financial package varies in format, terminology, and level of detail. Analysts must interpret and normalize data line by line, verify totals, and reconcile numbers across multiple documents.

Not only is this time-consuming, but it also introduces risk. A simple miscalculation or transcription error can affect loan approvals or investment recommendations. Moreover, manual workflows can’t scale with volume, limiting your ability to process multiple applications efficiently.

How Automation Streamlines Spreading

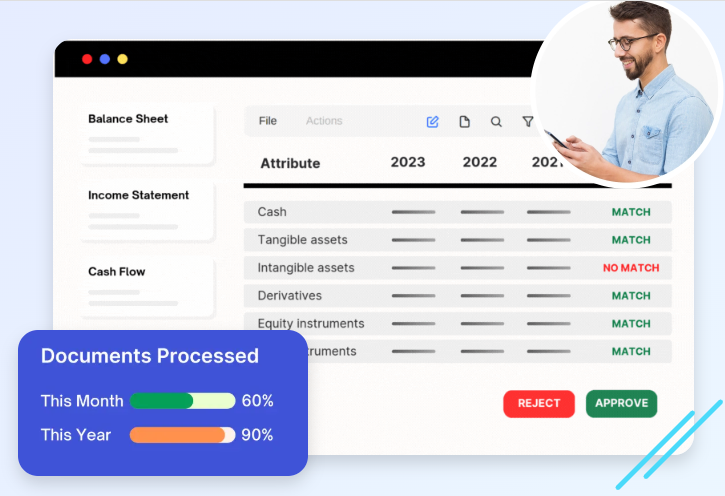

Modern technology is redefining financial statement spreading. AI-powered solutions now use intelligent document processing and natural language understanding to extract, classify, and reconcile financial data with precision. These systems can ingest various formats, map line items accurately, and deliver structured outputs ready for analysis.

These platforms dramatically reduce turnaround times by automating data capture, reconciliation, and ratio generation. They also maintain data consistency across departments and ensure compliance with lending policies. The result is a faster, more scalable, and more reliable process.

Boosting Accuracy and Decision Quality

One of the most significant advantages of automated financial statement spreading is accuracy. Machine learning models trained on financial documents recognize standard naming, layout, and formatting variations, reducing misinterpretation. Auto-reconciliation tools cross-check figures to flag discrepancies in real time.

With clean and standardized data, credit analysts and underwriters can trust the numbers and focus on deeper financial insights. This empowers teams to make faster, more confident decisions and mitigates the risk of approving unqualified borrowers or rejecting viable applicants.

Supporting Credit, Lending, and Investment Workflows

Automated financial statement spreading benefits a wide range of financial professionals. Commercial lending helps speed and precision evaluate a borrower’s cash flow, debt service coverage, and liquidity. For investment analysts, it streamlines portfolio evaluation, comparable company analysis, and forecasting.

Even internal finance teams benefit, as spreading supports budgeting, performance benchmarking, and strategic planning. Ultimately, automated spreading provides a data foundation that improves operational efficiency and strategic insight.

Integrating Spreading Into End-to-End Workflows

Automation truly delivers when it’s part of a seamless digital workflow. Leading platforms offer document intake portals, financial data extraction engines, ratio calculators, and dashboards all in one system. When integrated into loan origination or credit systems, spreading financial statements becomes an invisible yet powerful part of daily operations.

Teams no longer have to waste time moving data between platforms or juggling multiple tools. This reduces the chances of error and accelerates loan processing cycles, helping institutions serve customers faster and more effectively.

Enhancing Compliance and Audit Readiness

Beyond efficiency, spreading automated financial statements also supports compliance. Financial institutions can easily meet regulatory requirements with audit trails, version control, and system-enforced rules. If numbers change or need to be validated, stakeholders can trace every step of the data extraction and transformation process.

This transparency helps institutions maintain internal control, reduce regulatory risk, and demonstrate diligence during audits or reviews. Compliance teams gain confidence that data used in credit decisions is accurate, verified, and stored securely.

Key Features to Look For in an Automation Platform

When selecting a solution for financial statement spreading, focus on these core features:

- High accuracy in document classification and data extraction

- Ability to reconcile values across multiple statements

- Multi-format and multi-language support

- Ratio generation and financial analytics

- Dashboard and reporting functionality

- Seamless integration with lending or ERP systems

Choosing the right platform ensures your team speeds up the spreading process and extracts deeper value from financial data.

Why Now Is the Time to Modernize

The pressure to do more with less has never been higher in the financial services sector. Manual processes are no longer sustainable for teams handling high volumes of credit applications or portfolio evaluations. Automation offers a clear path forward by removing repetitive tasks and unlocking new speed, accuracy, and insight levels.

As market competition intensifies, organizations adopting modern financial statement spreading tools will position themselves as agile, data-driven leaders. Those who delay risk falling behind on efficiency, compliance, and customer satisfaction.

Conclusion

Financial institutions today cannot afford to be bogged down by outdated, manual processes. Automating financial statement spreading enables organizations to make faster, smarter, and more confident decisions backed by accurate, structured data.

The benefits of automation are tangible and immediate, from reducing operational bottlenecks to improving credit quality and enhancing customer experience. Financial professionals who embrace this transformation will gain a competitive edge and a foundation for future growth.

If you aim to simplify workflows, improve accuracy, and stay ahead in a data-driven industry, now is the time to modernize the spread of financial statements.