Every loan decision begins with numbers, and behind those numbers are hours of manual work. Many lenders still spend countless hours spreading financial statements, checking figures, and fixing formatting errors. As competition grows and loan volumes increase, this slow process starts to feel outdated.

This blog explores how artificial intelligence changes that routine. You’ll see how automation in financial spreading software reshapes financial spreading, the benefits and challenges lenders face, and practical steps for using AI effectively.

Let’s understand how smarter tools are transforming how credit teams handle data.

What Is Financial Spreading and Why It Matter

Before discussing AI, it helps to know why spreading even exists and why it often becomes a bottleneck for lenders.

Definition and Traditional Workflow

Financial spreading software is the process of transferring financial statement data, like balance sheets and income statements, into a standardized format so analysts can evaluate a borrower’s performance. Traditionally, teams do this by hand. They pull data from PDFs, Excel sheets, and scanned statements, then re-enter it into templates or credit systems.

This approach works but demands hours of focus. One miskeyed number or mismatched line item can affect ratios and risk grades. Multiply that across hundreds of clients, and you start to see how much time disappears into spreadsheets instead of analysis.

The Cost of Inefficiency

Manual spreading doesn’t just slow things down; it also introduces inconsistency. Each analyst might use slightly different mapping rules or naming conventions. That inconsistency makes it harder to compare borrowers across portfolios. Errors slip through easily, and credit reviews get delayed.

For lenders, these inefficiencies translate into missed opportunities and longer turnaround times. Teams spend their energy cleaning data instead of evaluating trends, forecasting cash flow, or advising clients.

How AI Transforms the Spreading Process

Automation powered by artificial intelligence changes the way lenders approach spreading. Instead of typing numbers line by line, AI systems learn to read, interpret, and categorize data almost instantly.

Core Capabilities of AI-Enhanced Spreading

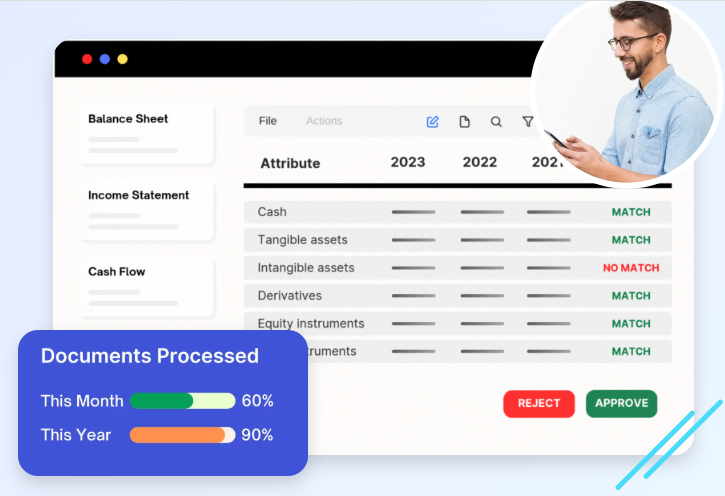

AI tools can extract data from multiple file formats such as PDFs, images, spreadsheets, and map them directly into a structured database. Over time, they recognize patterns, such as how a specific company labels its statements, and adjust automatically.

They also highlight unusual figures or sudden changes, helping analysts spot risks early. Machine learning lets the system improve as it processes more statements, meaning accuracy grows without adding headcount. This creates faster, cleaner, and more consistent results.

Use Cases in Lending Environments

In practical terms, AI spreading shortens loan approval cycles. It helps credit departments handle a larger volume of applications without burning out the team. Beyond new loans, lenders can also use it to refresh existing client spreads regularly, keeping portfolio data up to date for better monitoring.

Hybrid setups are becoming common, too. AI handles bulk tasks, while analysts focus on judgment-heavy cases or flagged exceptions. The result is a smoother, more balanced workflow.

Benefits and Risks for Lenders

AI adoption brings strong rewards, but it also asks lenders to rethink how they manage data and oversight.

Key Advantages

The most obvious benefit is time. Tasks that once took hours can be completed in minutes, freeing analysts to focus on insights instead of input. Accuracy improves, too, since AI doesn’t get tired or distracted.

As portfolios grow, automation allows you to process more data without hiring additional staff. It also provides a clear audit trail—every spread and data point can be traced back to its source, supporting internal and regulatory reviews.

Perhaps the most valuable outcome is decision quality. With faster, reliable data at hand, teams can evaluate credit risk with more confidence and act sooner when issues appear.

Challenges and Risks to Manage

Of course, AI isn’t perfect. Its success depends on the quality of the data it receives. Poorly formatted statements or incomplete files can still cause errors. Integrating new software into legacy systems may also take time.

Transparency is another issue. Some AI models are difficult to interpret, which can raise questions from auditors or regulators. That’s why lenders should balance automation with human checks. Training staff to understand when to rely on AI—and when to override it—keeps processes trustworthy.

Change management matters too. Teams need time to build confidence in the technology. Clear communication and visible wins early on help everyone adapt.

Conclusion

The evolution of financial spreading software points toward a smarter, more responsive future for lending. Soon, AI won’t just record what has happened but also will predict what might happen next. You could see tools that flag potential borrower stress before it appears in the numbers or suggest early interventions for at-risk clients.

By blending analytical skill with AI precision, lenders can move faster and think ahead. The future is about giving it better data and more time to make the right call.