IMARC Group has recently released a new research study titled “South Korea Menswear Market Size, Share, Trends and Forecast by Product Type, Seasons, Distribution Channel, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Menswear Market Overview

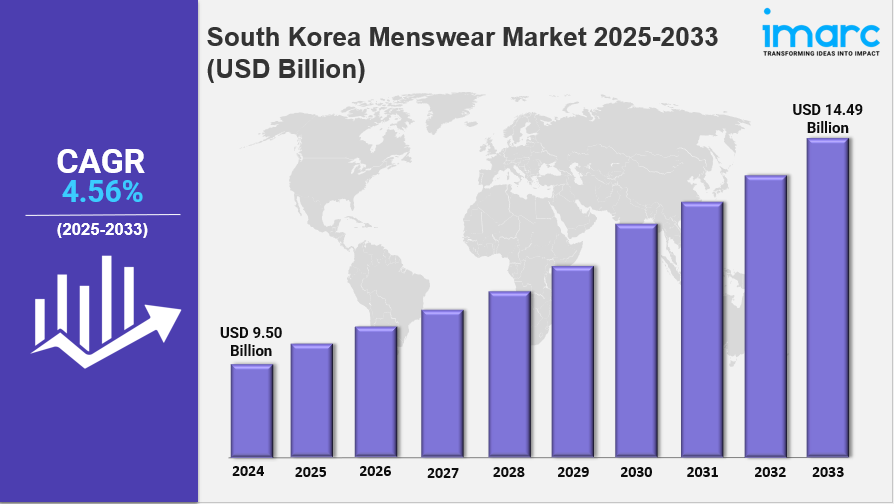

The South Korea menswear market size was valued at USD 9.50 Billion in 2024 and is projected to reach USD 14.49 Billion by 2033, growing at a CAGR of 4.56% during the forecast period of 2025-2033. Rising fashion consciousness, influence of K-pop and K-culture, personalized and tailored clothing demand, and expanding e-commerce are key drivers. The market reflects growing consumer interest in stylish, expressive fashion that blends tradition and modernity.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Menswear Market Key Takeaways

- Market Size in 2024: USD 9.50 Billion

- CAGR (2025-2033): 4.56%

- Forecast Period: 2025-2033

- Growing fashion consciousness among South Korean men fuels demand for personalized, tailored clothing.

- The global rise of K-pop and Korean cinema influences menswear trends and drives gender-fluid fashion popularity.

- The rapid growth of e-commerce, generating around USD 25 billion in 2024, offers accessible and diverse shopping options.

- Casualization of office wear reflects a shift towards smart-casual styles prioritizing comfort and individuality.

- Sustainability trends fuse traditional Korean aesthetics with modern fashion, notably through modernized hanboks.

- Gender-neutral and androgynous fashion gains traction, emphasizing freedom of expression among younger consumers.

Sample Request Link: https://www.imarcgroup.com/south-korea-menswear-market/requestsample

Market Growth Factors

Fashion consciousness among South Korean men is a major growth driver for the menswear market. Demand for clothing reflecting personal style and identity leads men to seek customized and tailored outfits with better fit, exclusivity, and expression. Personalized fashion is viewed as a mark of sophistication and confidence, pushing brands to offer bespoke options that match evolving consumer preferences.

The influence of K-pop, K-dramas, and Korean cinema plays an instrumental role in shaping menswear styles. Male celebrities blend streetwear and high fashion, creating trendy, statement pieces. As K-culture expands globally, it solidifies South Korea’s status as a menswear trendsetter, with celebrity-driven styles driving consumer behavior domestically and internationally. Fashion brands frequently collaborate with stars to boost visibility.

E-commerce growth revolutionizes menswear shopping in South Korea. In 2024, fashion e-commerce sales generated about USD 25 billion, comprising approximately 18% of total online sales, second only to electronics. Digital platforms offer extensive brand and style access, real-time feedback, and influencer marketing, enabling consumers to explore and adopt niche trends. Mobile shopping dominates, accelerating trend adoption and supporting innovative, smaller brands.

Market Segmentation

By Product Type:

- Trousers: Cater to formal and casual wear with tailored and relaxed cuts; driven by office and smart-casual trends; favored for comfort and versatility.

- Denims: Durable and casual wardrobe essentials; various washes and fits appealing to young and middle-aged consumers.

- Shirts and T-Shirts: Foundation of everyday menswear; t-shirts emphasize graphic designs and comfort, shirts range from classic to fashion-forward styles.

- Ethnic Wear: Niche but growing through modernized hanbok and culturally inspired designs, appealing to youth embracing heritage.

- Others: Includes outerwear, knitwear, activewear, and accessories; reflects seasonal style, health-conscious lifestyles, layering options, and completing looks.

By Seasons:

- Summer Wear: High demand due to hot, humid climate; lightweight, breathable, trend-driven designs such as t-shirts and linen shirts.

- Winter Wear: Significant for cold winters; consumers prioritize warmth and layering with coats, padded jackets, and knitwear as statement pieces.

- All-Season Wear: Practical, versatile items like denim and neutral-toned layers; supports mix-and-match wardrobes favored by minimalist shoppers.

By Distribution Channel:

- Supermarkets and Hypermarkets: Affordable basics for convenience-focused, price-sensitive customers; popular in suburban and rural areas.

- Exclusive Stores: Premium experience with curated collections and personalized service; cater to loyal, fashion-conscious buyers.

- Multi-Brand Retail Outlets: Offer diverse styles balancing affordability and trendiness; showcase local and international labels.

- Online Stores: Dominant in retail; provide convenience, broad selection, personalized recommendations, influencer marketing, and fast shipping.

- Others: Department stores, pop-up shops, and mobile vendors offering luxury blend, buzz generation, and local engagement.

Regional Insights

The Seoul Capital Area dominates the South Korea menswear market as the fashion and cultural hub. It leads trends by hosting flagship and luxury stores, fashion events, and exhibiting high digital engagement with global style exposure. This region is a primary market for innovation, premium fashion, and youth-driven trends. Other regions such as Yeongnam, Honam, Hoseo, and others exhibit varying market maturity, with preferences balancing modern and traditional styles and increasing fashion awareness driven by digital media.

Recent Developments & News

- May 2025: PUMA launched its global H-Street experience in Seoul, showcasing the H-Street trainer with collaborations involving Korean creatives.

- April 2025: JiyongKim opened its first flagship store in Seoul, featuring sun-bleached menswear in a minimalistic gallery-like setting.

- February 2025: Athler secured KRW 4 billion (USD 3 million) Series A funding to expand offerings for men in their 30s and 40s, featuring over 600 brands.

- January 2025: Salomon Korea introduced the Slate Collection blending high fashion and technical menswear functionality with GORE-TEX.

- July 2024: Gen.G collaborated with streetwear brand LIBILLY for the “2024 Gen.G x LIBILLY Collection” merging e-sports and fashion.

Key Players

- PUMA

- JiyongKim

- Athler

- Salomon Korea

- Gen.G

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302