IMARC Group has recently released a new research study titled “South Korea Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Drones Market Overview

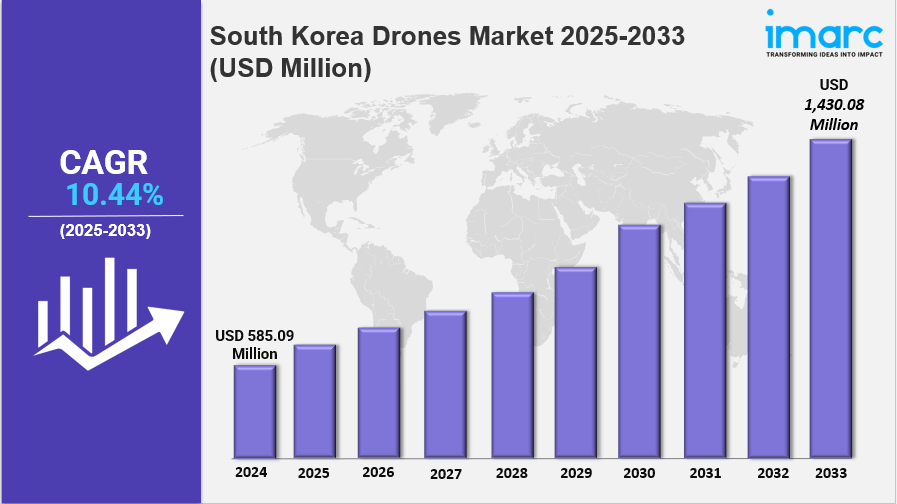

The South Korea drones market size reached USD 585.09 Million in 2024 and is projected to grow to USD 1,430.08 Million by 2033. The market is expected to expand at a CAGR of 10.44% during the forecast period 2025–2033. Growth is driven by strong government support, advanced technological infrastructure, and increasing drone adoption across various industries such as smart cities, agriculture, and industrial maintenance.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Drones Market Key Takeaways

- Current Market Size: USD 585.09 Million (2024)

- CAGR: 10.44%

- Forecast Period: 2025-2033

- The market benefits from strong government backing supported by a comprehensive national drone strategy aiming to promote domestic drone innovation and usage.

- Urban centers like Seoul, Busan, and Incheon utilize drones for traffic monitoring, infrastructure inspection, and emergency management in smart city projects.

- Precision agriculture is driving drone adoption, with local firms developing specialized solutions for crop spraying, field mapping, and monitoring.

- Industrial inspections at shipyards and factories benefit from drones enhancing safety and operational efficiency.

- The market segmentation covers type, component, payload, point of sale, end-use industry, and regional aspects for detailed analysis.

Sample Request Link: https://www.imarcgroup.com/south-korea-drones-market/requestsample

Market Growth Factors

The South Korea drones market growth is primarily fueled by robust government support and an extensive national drone strategy. The government has implemented simplified certification procedures, created drone corridors, and invested in vertiports and test facilities. These initiatives foster a favorable environment for startups and companies to innovate and test technologies related to urban air mobility, delivery, inspection, and surveillance. Emphasizing domestic production and localization, South Korea aims to reduce import dependence and position itself as a regional leader in aerospace technologies. This comprehensive policy framework is instrumental in driving drone adoption across industries and expanding supply chains from component manufacturing to full drone integration.

Urban centers such as Seoul, Busan, and Incheon lead innovation by incorporating drones into smart city infrastructure planning and operations. Drones are utilized for air quality monitoring, traffic management, infrastructure inspection such as bridges and high-rises, and emergency response. Pilot programs for drone deliveries of medical equipment and e-commerce parcels are being conducted in metropolitan and island regions. The high integration of digital infrastructure including IoT and 5G connectivity with drone operations enhances the utility and adoption rate of drones in urban environments uniquely characteristic of South Korea’s smart cities.

Precision agriculture and industrial inspection also represent significant growth areas. South Korea’s farming industry adopts drones for precision tasks like crop spraying and field monitoring to manage labor shortages and improve yield quality. Specialty crops such as ginseng and tea benefit from drone-assisted stress detection and microclimate control. Industrial applications include safety-enhanced inspections at shipyards, offshore platforms, and factories, minimizing downtime and offering detailed imagery for maintenance. Local companies, such as Daedong, launch precision farming services, underscoring the convergence of agricultural and industrial uses driving the market forward.

Market Segmentation

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

*This categorization provides detailed analysis of the market based on drone types including fixed wing, rotary wing, and hybrid.*

Component Insights:

- Hardware

- Software

- Accessories

*The market is analyzed according to components used in drones, including hardware, software, and accessories.*

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

*Detailed segmentation by payload capacity is provided, differentiating drones based on their carrying weight capabilities.*

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

*Breaks down the market by sales channel, distinguishing between OEM sales and aftermarket activities.*

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

*Segments the market by industry verticals where drones are applied, covering a broad spectrum including defense and commercial sectors.*

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

*The market includes comprehensive regional analysis across major South Korean regions.*

Regional Insights

The Seoul Capital Area emerges as the dominant region for drone adoption in South Korea, supported by its status as an urban intelligence hub. The market benefits from advanced smart city initiatives leveraging drones for infrastructure inspection, traffic monitoring, and emergency response. Synergies with high-speed 5G connectivity and IoT infrastructure stimulate growth uniquely in this region. Specific statistics on market share or CAGR by region are not provided in the source.

Recent Developments & News

In March 2025, South Korea’s military advanced its unmanned technology efforts despite a recent incident involving an Israeli-developed drone. The military is progressing with development of a loyal and covert wingman drone intended to support the air force’s new KF-21 Boramae fighter jets. This exemplifies ongoing innovation in domestic UAV military applications.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302