IMARC Group, a leading market research company, has recently released a report titled “Power Transformer Market Report by Core (Closed, Shell, Berry), Insulation (Gas, Oil, Solid, Air, and Others), Phase (Single, Three), Rating (100 MVA To 500 MVA, 501 MVA To 800 MVA, 801 MVA To 1200 MVA), Application (Residential and Commercial, Utilities, Industrial), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global power transformer market size, share, trends, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Power Transformer Market Overview:

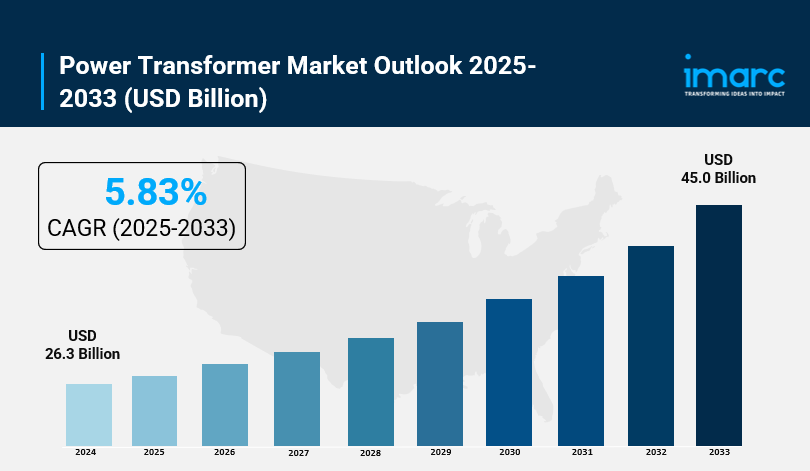

The global power transformer market size reached USD 26.3 Billion in 2024 and is expected to reach USD 45.0 Billion by 2033, growing at a CAGR of 5.83% during the forecast period 2025-2033. The market growth is driven by increasing electricity demand in industrial and commercial sectors, extensive renewable energy utilization, and rising installations of smart meters and grids.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Power Transformer Market Key Takeaways

- Current Market Size: USD 26.3 Billion (2024)

- CAGR: 5.83%

- Forecast Period: 2025-2033

- The market is primarily driven by escalating demand for electricity in industrial and commercial sectors to operate electronic appliances and heavy machinery.

- Extensive utilization of renewable energy sources and rising installation of smart meters and grids support market growth.

- The growing trend of industrialization and the replacement of existing infrastructure stimulate market expansion.

- Increasing adoption of smart or digital transformers enables improved grid management and predictive maintenance.

- Asia Pacific dominates the market due to urbanization, industrialization, and heavy investment in electrical grid expansion.

Request Your Free “Power Transformer Market” Insights Sample PDF: https://www.imarcgroup.com/power-transformer-market/requestsample

Market Growth Factors

The growth of the global power transformer market can be attributed to the rising need for advanced and more efficient electricity distribution systems. This is mainly due to the increasing installations of renewable sources of energy such as solar and wind energy that produce variable output and increasing electricity consumption in industries and commerce to drive machines and electronic devices. Other market drivers include replacement of old infrastructure and establishment of new transformer units as energy networks expand to new regions.

Increasing demand for smart or digital power transformers, which enables real time monitoring of load, voltage, and temperature for predictive maintenance, is driving the growth of the market. Increasing implementation of high-efficiency transformers with improved designs and manufacturing materials helps in reducing the energy losses and thereby driving the market.

Government spending on electrification, research and development of new technologies, and upgrading of rural and urban power infrastructure is expected to benefit the market. Initiatives by government for modernization of power infrastructures in the rural and urban regions of the country and promoting renewable energy adoption such as DDUGJY, IPDS, and PM KUSUM are increasing the demand.

Market Segmentation

Breakup by Core:

- Closed

- Shell

- Berry

Shell is the largest segment, consisting of a core made from high-permeability materials like silicon or amorphous steel, which minimize core losses and improve transformer efficiency.

Breakup by Insulation:

- Gas

- Oil

- Solid

- Air

- Others

Oil insulation has the largest market share, widely used in fluorescent lamp ballasts, high-voltage capacitors, oil-filled transformers, and circuit breakers. It prevents arcing and electrical breakdown with high dielectric strength and protects components like copper coils from damage.

Breakup by Phase:

- Single

- Three

The three-phase segment dominates, driven by demand in manufacturing, mining, petrochemical, and telecommunication sectors for power generation and distribution.

Breakup by Rating:

- 100 MVA To 500 MVA

- 501 MVA To 800 MVA

- 801 MVA To 1200 MVA

100 MVA to 500 MVA transformers hold the largest share, extensively used to step up voltage in thermal, hydroelectric, and wind power generation for long-distance transmission.

Breakup by Application:

- Residential and Commercial

- Utilities

- Industrial

Industrial application leads the market, where power transformers efficiently distribute electricity within industrial facilities and machines, including high-current usage in steelmaking arc furnaces.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific is the dominant region in the power transformer market, accounting for the largest market share due to rapid urbanization and industrialization. The region’s market growth is supported by massive investments in transmission infrastructure and energy storage systems, such as the US$77 Billion investment planned by the State Grid Corporation of China for 2023. Additionally, increasing renewable power integration from large utility-scale farms in countries like India and China, along with electrification of buildings, industries, and rise in data centers, bolsters the regional market.

Recent Developments & News

- September 2023: Servokon Systems Ltd. announced plans to invest over Rs 200 Crore in a new manufacturing facility in Hapur, Uttar Pradesh, covering 25,000 sq meters to enhance production capabilities.

- August 2023: Delivery of the last of 12 power transformers for the Valenzuela 500 KV substation was completed, crucial for bolstering regional energy capacity.

- June 2023: Charles River Analytics received a $1.1 Million SBIR Phase II contract to develop a predictive maintenance diagnostic platform for electrical transformers using its POWERED tool to prevent failures and power shutdowns.

Key Players

- Bharat Heavy Electricals Limited

- Daihen Corporation

- General Electric Company

- Hitachi Ltd.

- Hyosung Heavy Industries Corporation

- Hyundai Electric & Energy Systems Co. Ltd.

- Kirloskar Electric Co. Ltd.

- Mitsubishi Electric Power Products Inc. (Mitsubishi Electric Corporation)

- Schneider Electric Se

- Siemens Energy AG

- The Kraft Heinz Company

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Browse More Articles:

- Home Decor Market: https://regic.net/home-decor-market-size-share-and-trends-report-2034/

- https://regic.net/time-with-assignee-per-status-jira-time-in-status-reports/