Loan teams move quickly, yet you’ve likely felt how a small issue in a borrower’s financials can slow the entire review. As lending volumes rise and new industries add different reporting styles, the pressure to work cleanly grows. Many delays don’t happen because the analysis is hard, but they show up because the starting point is messy.

In this blog, we take a look at why spreading often takes longer than expected and what you can do to streamline the process. You’ll also see how stronger habits reduce errors and keep financial spreading on track without extra stress.

Common Mistakes That Slow Down Financial Spreading

Below are some mistakes that hold teams back and stretch review cycles longer than needed.

Relying on Old Templates

Templates tend to stay in place long after business reporting styles change. You might use a format that worked years ago but now misses newer categories or updated layouts. This forces you to adjust lines manually each time a borrower shares a fresh statement.

You shift cells around, rewrite sections, and try to match items that don’t sit neatly in the old structure. These small edits pile up, and before long, your template becomes the reason things move slowly.

As more industries adopt their own reporting patterns, outdated formats turn into hurdles you feel every day. You also face the risk of formulas breaking or calculations no longer matching the new layout. This creates a ripple effect that takes more time to fix and slows the decision process further.

Entering Data Manually

Manual entry plays a role, but relying on it without guardrails can invite trouble. When several analysts work on one borrower, subtle differences in how someone inputs data can change totals or ratios.

A misplaced digit, skipped sign, or extra zero throws off results that the next person now has to investigate. By the time someone catches the issue, you must recheck earlier entries, correct formulas, and confirm that ratios now match the source documents.

Review meetings stretch longer because you pause to explain inconsistencies or go back to trace the root of a number. Each correction seems small on its own, yet when they happen often, they slow the entire lending cycle.

Using Inconsistent Spreading Standards

Teams in different branches or units sometimes develop their own habits. One group classifies line items differently, another uses its own method for cash flow adjustments, and someone else calculates ratios in a slightly different order.

When spreads move upward for approval, reviewers must compare versions that don’t align. This leads to long comment threads asking for clarity or requesting an updated version that follows the agreed structure.

The more variation you have, the more time you spend bringing everything back to a consistent format. These inconsistencies make spreading feel more complicated than it needs to be and add unnecessary steps to the approval chain.

Missing Context Behind the Numbers

A spread filled with numbers, but no explanation, makes the review harder. When revenue jumps, or margins slide, the reviewer expects a short note explaining why.

Without context, you leave decision-makers guessing or checking other documents to understand the move. This missing piece slows credit assessments and forces new questions that could have been answered earlier.

You might understand the business well, but the person approving the loan may not. When spreads reach them without commentary, the back-and-forth increases, and the decision gets pushed back.

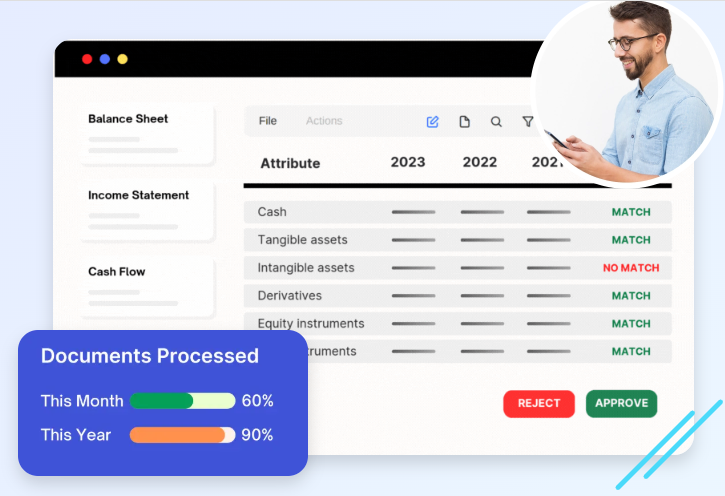

Limited Validation Rules

A spread that lacks basic checks can hide errors until late in the process. You notice something off only during the final review, at a point when changes feel more disruptive. Early validations like checking signs, verifying balances, or confirming totals make the work cleaner.

Without them, you rely on manual checks that take longer and demand more attention. This slows down the cycle because every correction must be reviewed again for accuracy. When issues appear late, even simple adjustments stretch into longer delays.

How Banks Can Avoid These Delays and Improve Spreading

Below are some practices that help credit teams stay consistent, accurate, and quicker during review cycles.

Build Clear Templates and Standard Structures

A well-designed template gives you a steady base. When every analyst uses the same layout, line mapping, and ratio definitions, you reduce confusion and rework. You don’t need to go back and fix mismatched sections or adjust figures that came from a different style.

Strengthen Review Habits

Good spreading habits pay off. When the team checks early for missing values, unusual movements, or incorrect signs, many problems surface before the review stage. You don’t spend extra hours correcting issues later or redoing explanations that could have been written sooner.

Give Analysts Better Context Tools

You move faster when your spread tells a clear story. Adding comments next to major changes or attaching brief notes about market conditions helps reviewers understand what is happening. This cuts down the need for long follow-ups asking for explanations.

Conclusion

Speed and accuracy in financial spreading depend on habits, structure, and the tools that support your team. When you remove small mistakes early, the entire credit review process moves with less friction. As lending becomes more data-heavy, you will need clean processes that adapt quickly and keep your pace steady.

Future lending decisions will reward teams that work with clarity and smart routines, not rushed fixes. By refining the way you manage financial spreading, you set yourself up for faster approvals and sharper insights without stretching your workload.